London startup Tem has raised $75 million in a Series B funding round to grow its AI platform that handles electricity trading. The company matches renewable energy generators with businesses, aiming to lower costs in markets strained by old systems and rising demand from things like AI data centers. Lightspeed Venture Partners led the round, with other investors joining in.

Background

Tem started in 2021 when four people who worked at energy firm Limejump decided to fix problems they saw in how electricity gets bought and sold. Limejump got bought by Shell in 2019, and those founders—Joe McDonald, Jason Stocks, Bartlomiej Szostek, and Ross Mackay—knew the wholesale market added too many middlemen and costs. They built a platform that uses AI to connect generators of renewable power, like solar and wind farms, directly to businesses that need energy.

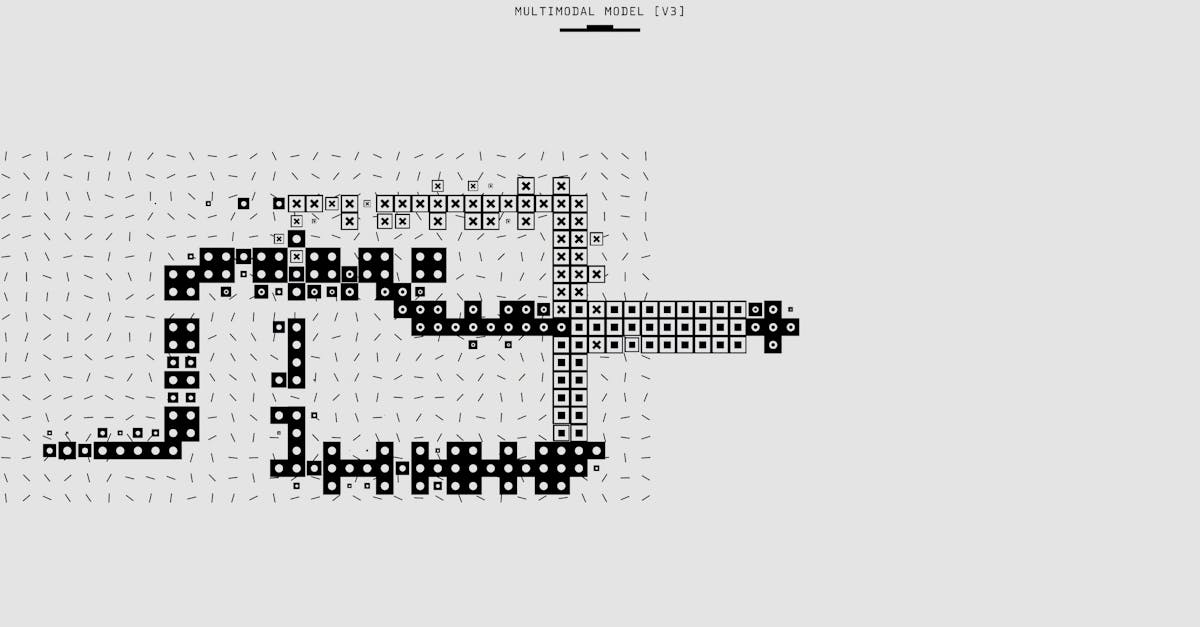

The energy world has changed fast. More renewables mean supply goes up and down with weather, and new demands from data centers push prices higher. Old trading systems, run by people and outdated software, struggle to keep up. Tem's software steps in with machine learning to predict supply and demand, then matches buyers and sellers in real time. It processes billions of possible matches every second to find the best deals.

In the UK, where Tem operates now, the company has signed up over 2,600 business customers. Companies like fast-fashion group Boohoo, drink maker Fever-Tree, and soccer team Newcastle United FC use it. They get power that's fully traceable to renewables and pay less than through traditional routes.

Tem runs two main parts. One is Rosso, the core transaction engine that does the matching with AI. The other is RED, a utility service that buys and sells energy itself to show how well Rosso works. RED is the only utility using Rosso right now, but Tem plans to open it to others later.

Key Details

The $75 million round was oversubscribed, meaning more investors wanted in than expected. Lightspeed led it, joined by Atomico, AlbionVC, Allianz, Revent, Hitachi Ventures, Schroders Capital, and Voyager Ventures. One person close to the deal said it values Tem at over $300 million.

Tem will use the money to enter the U.S., starting in Texas, and Australia. Both places have old grid systems and big pushes for renewables, creating room for new tech. In Texas, for example, wind and solar are huge, but matching them to users is tricky.

How the Platform Works

Rosso uses algorithms and large language models to forecast energy flows. It cuts out five or six layers of traders and back-office teams that take cuts in normal markets. This gets prices closer to wholesale levels for buyers and more money to generators.

Businesses save up to 30% on bills with RED. The platform keeps prices stable, often 10 times below market floors, with fewer surprises from volatility. Generators get better payouts because there's no markup chain.

“We’re in a nice position where we kind of have control over our own profitability. So I could have chosen not to raise at all and had a lovely, nice bootstrap business in some ways. Well, we’re not that kind of business. We know what we want to achieve as someone who wants to go public over the years.” – Joe McDonald, co-founder and CEO of Tem

McDonald said Tem focuses on decentralized setups, like small renewables and businesses, because they suit AI best. It scales to big enterprises too. The founders saw at Limejump how manual trading wasted money, so they built this to automate it.

Tem has already handled millions of pounds in transactions. Its AI handles high-speed decisions that humans can't match, especially as distributed energy—like home solar or small batteries—grows.

What This Means

This funding puts Tem on a path to change how electricity moves around. By shrinking the gap between generator prices and what buyers pay, it could make renewables cheaper and easier to use. That helps businesses cut costs and hit green goals without paying extra for fossil fuels.

For generators, higher earnings mean more investment in solar, wind, and storage. In places like the U.S. and Australia, where grids face blackouts from weather or peaks, Tem's tools could balance supply better and avoid waste.

The shift matters as AI data centers suck up power. Traditional grids can't adjust fast, but direct AI matching might keep prices down. Tem sees itself like AWS or Stripe—neutral infrastructure that anyone can use, no matter who owns the power plants or customers.

Opening Rosso to other utilities will spread the tech wider. RED proves it works but can't take the whole market. Tem wants its engine in all trades, boosting efficiency across the board.

Investors see big potential. A mix of venture firms and big players like Hitachi and Schroders shows trust in Tem's model. As countries push for net zero by 2050, platforms like this could speed up the switch from oil and gas.

Tem's growth comes at a time when energy prices have spiked, making alternatives urgent. Businesses want stable, green power without the wholesale hassle. If Tem scales as planned, it could handle a chunk of trading in key markets, making clean energy the default choice.